Preface

I like to keep a certain amount of capital in my Australian banks savings account that I like to leave untouched.

This cash is there to serve two primary purposes:

- Acts as emergency fund

- Covers any future taxes owed

However, unfortunately the bank I've been with since the age of 5, Commonwealth Bank, offers a measly return of 0.05% which is just not good enough. Fortunately, Westpac has an offer available to those aged 18-29 which allows you to earn up to 3% p.a. on your savings for balances up to $30000 AUD.

Terms and Conditions

You are given two accounts with Westpac upon signing up to this offer, a Westpac Choice account (everyday account) and a Westpac Life account (savings/growth account).

To receive the full 3% interest and pay no extra fees you must meet some criteria which I have summarised below:

- Be 18-29 years old

- Westpac Choice account and Westpac Life account must both have a balance > $0

- You must make 5 transactions with your debit card per month (ATM withdrawals and BPAY etc don't count)

- Westpac Life account must grow every month (based on comparison of balance 1st of month and 1st day of following month)

- You must deposit at least $2000 into your Westpac Choice account to avoid the monthly account fee (this is also waived for students and some other eligible customers). Note that you can immediately withdraw the deposited funds as long as they 'flow' through the account.

With these requirements well defined, it is easy to make an automated transaction loop to receive your 3% earnings without ever actually logging into your Westpac account or using it manually.

Automation

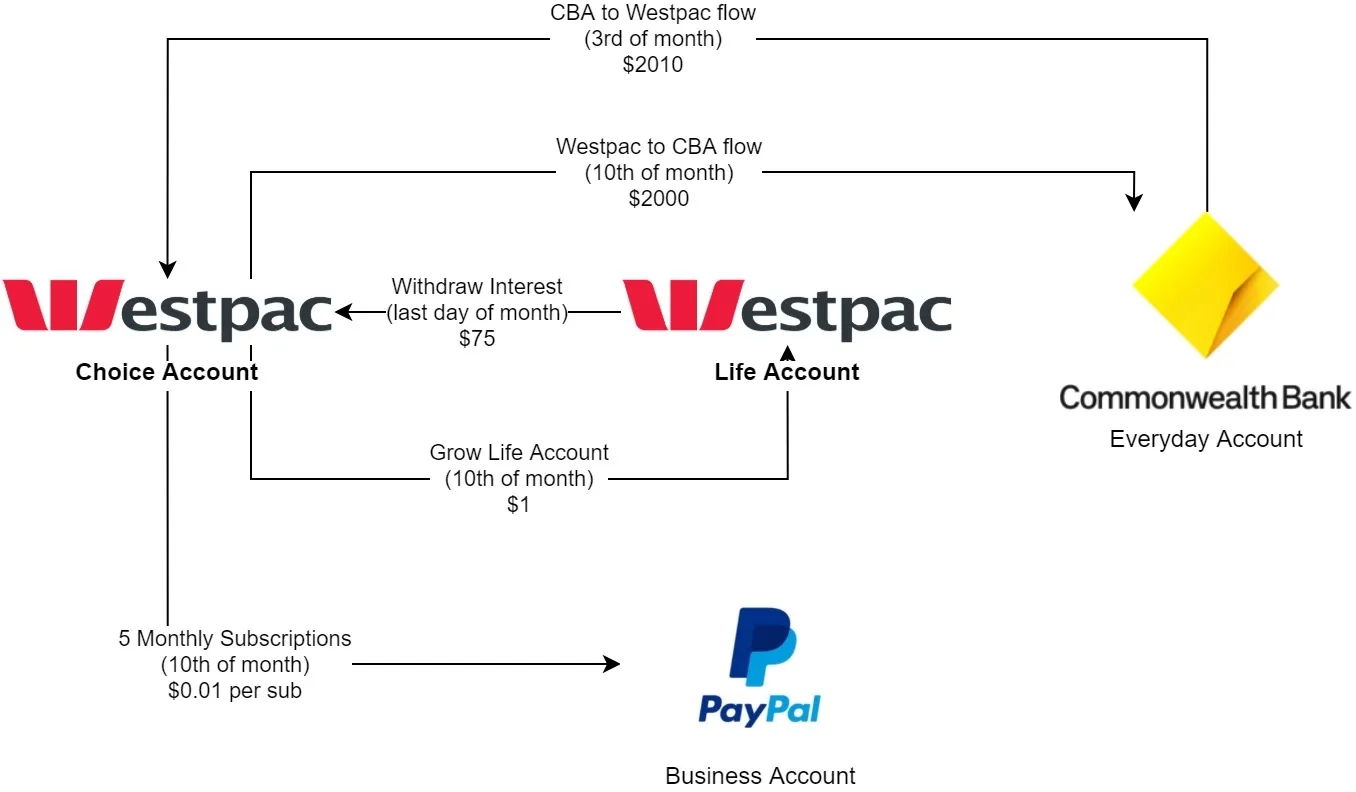

This is the final product of our automation efforts:

On the 3rd of the month:

- CBA to Westpac flow: We deposit $2010 into our Westpac account to get rid of monthly account fees.

On the 10th of the month:

- Westpac to CBA flow: We deposit $2000 into our CBA account (just taking back the money we deposited less ~$10 that we will use for other steps).

- 5 monthly subscriptions: We decide to use PayPal to setup 5 subscriptions to a business account to charge us the amount of $0.01 five times every month satisfying that requirement.

- Grow Life Account: We deposit $1 into our Life account which grows it for the month.

On the last day of the month:

- Withdraw Interest (OPTIONAL) : Withdraw earned interest ($75 per month is 3% of 30k) into choice account so it can be withdrawn or put to other use. As amounts greater than 30k only benefit from a 0.40% interest rate there is little gain in letting the choice account grow beyond 30k.

- We can withdraw interest because the growth of the choice account is determined by comparing the balance on the 1st day of the month with the balance on the 1st day of the following month. Base account interest is deposited on the last day of the month and the bonus interest is deposited on the 20th of the following month. So, after the 1st month you open your Westpac account, you should be able to withdraw one months worth of the interest ($75) from your Westpac Life account to your Westpac Choice account. The account still grows however as since we deposit $1 each month so we still meet the requirements.

- Just be sure not to automate this step for the first month because you might withdraw too much interest due to the weird payout schedules.